Quick summary of MIE Solution’s Cost of Manufacturing Report:

- Atlanta, Houston and Columbus are the top U.S. cities to start a manufacturing business in, according to new research from MIE Solutions.

- Texas comes out top as the best state to start a manufacturing business, thanks in part to its lack of corporate income tax, as well as cheaper utilities and rent for commercial buildings.

- The findings reveal why manufacturing management software and automation adoption are becoming critical to offsetting rising labor, energy, and compliance costs in 2025.

The State of U.S. Manufacturing

Manufacturing in the United States has become as much a matter of policy as it is of profit. With reshoring now a central theme in government strategy, global trade tensions reshaping supply chains, and foreign competitors investing heavily in domestic production, manufacturers are under mounting pressure to evaluate their US presence.

The decision is no longer just about land costs or tax incentives; it’s about navigating rising labor expenses, energy volatility, and a policy environment that could define the future of American manufacturing.

Representing 10% of the national economy, U.S manufacturing is under significant pressure. The Manufacturing Purchasing Managers’ Index (PMI) has hovered below the critical 50-point threshold for much of 2025, registering 48.7% in August – the sixth straight month of contraction. Tariff uncertainty has further weighed on production, with new orders only partly offsetting the decline.

Labor dynamics are at the heart of this challenge. Research projects that 1.9 million manufacturing positions could go unfilled by 2033, while factory employment hit a five-year low in July. Skilled workers are scarce and unevenly distributed across regions, with traditional hubs in the Midwest and the South hardest hit, according to Manufacturing Today.

Inadequate infrastructure, under-resourced education systems, and regional talent shortages are reshaping corporate priorities, making workforce availability a decisive factor in location strategy ahead of traditional cost considerations.

The net effect is a U.S. manufacturing landscape that demands more than traditional cost-based calculations. Manufacturers succeeding in this environment today are those recognizing that location strategy must now balance immediate cost pressures with long-term positioning, where talent, technology, and adaptability matter just as much.

The Cost of Manufacturing Report

To better understand the true cost of manufacturing across different cities and states, MIE Solutions analyzed over 50 cities across U.S. states, examining key factors that drive both operational expenses and competitiveness.

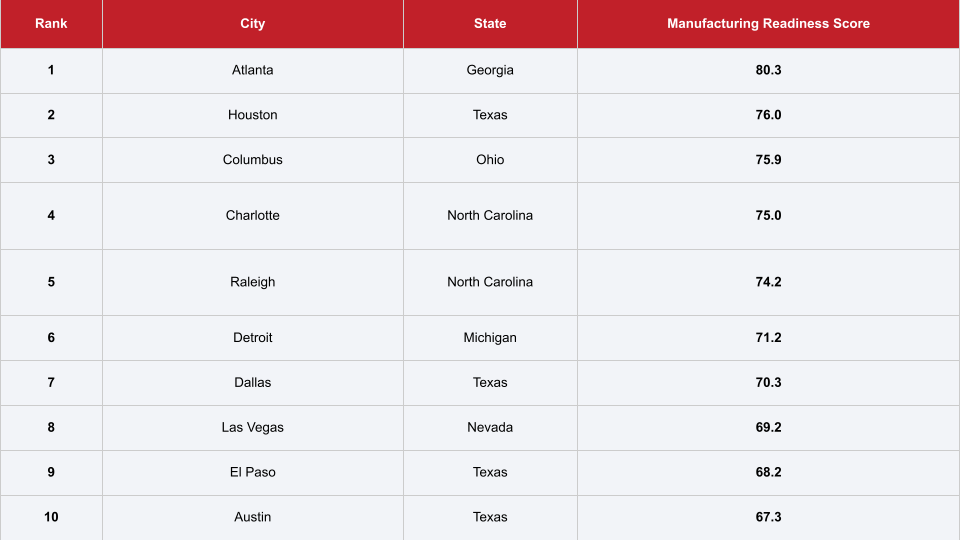

Each city was assigned a weighted score out of 100, based on affordability, talent access, energy costs, and overall business-friendly conditions. These were then compiled into a ‘Manufacturing Readiness Score’ for each U.S. city.

The result is the ‘Cost of Manufacturing Index,’ a data-driven benchmark that identifies which cities and states are best positioned to support new manufacturing ventures and provides leaders with actionable insights to guide location strategy and operational planning.

Top 10 U.S. Cities to Launch a Manufacturing Business in 2025

The research shows that out of 50 cities analyzed, Atlanta, Georgia, leads the nation with a score of 80.3/100, followed closely by Houston (76.0) and Columbus (75.9).

Each of these cities balance workforce availability, real estate affordability, and energy stability in ways that make them highly competitive.

What emerges from the index is a new map of American manufacturing opportunity. The cities at the top are not necessarily the legacy hubs of the past, but those that combine cost-effectiveness with forward-looking infrastructure and viable regional talent pipelines.

For companies weighing expansion in 2025, aligning with the right ecosystems of talent, infrastructure, and policy helps to sustain long-term growth.

The Cost of Manufacturing Index: Top 10 U.S. Cities

Georgia: Atlanta Sets the Pace for U.S. Manufacturing

Atlanta, Georgia, takes the top spot thanks to a rare combination of low energy costs (6.54 cents/kWh), competitive wages ($23.97/hr), and one of the lowest commercial rent averages in the dataset ($7 per sq. ft per year).

For startups and scaling manufacturers, this translates into reduced overheads across utilities, payroll and facilities, freeing up capital that can be reinvested into innovation, equipment upgrades, and digital transformation tools such as manufacturing management software.

Beyond its cost advantages, Atlanta’s logistics infrastructure sets it apart. As home to the world’s busiest airport and major interstate connections, the city offers unparalleled access to domestic and international markets. Combined with the Port of Savannah’s expansion and a thriving local workforce pipeline, Atlanta is likely to remain a magnet for manufacturing investment in 2025.

Texas: A Powerhouse of U.S. Manufacturing Growth

Texas dominates the index, with seven cities in the top 20 and four in the top 10: Houston (#2), Dallas (#7), El Paso (#9), and Austin (#10). This reflects not only Texas’s size but its diverse industrial base, from heavy energy and petrochemicals to advanced electronics and aerospace.

Houston, in particular, benefits from its large skilled job pool, with hundreds of recently opened positions in manufacturing roles (432), making it an ideal choice for fast-scaling companies. According to the Greater Houston Partnership, manufacturing will grow by 3,500 jobs in 2025 noting that manufacturing “is (Houston’s) single largest contributor to GDP, accounting for $1 in every $7 of Houston’s economic output.”

Dallas and Austin, meanwhile, offer strong talent pipelines bolstered by major universities and research institutions and competitive energy costs, though their commercial rents are slightly higher than Georgia. More information on this can be found in the ranking table below.

El Paso provides a strategic advantage for companies engaged in cross-border trade, benefiting from its proximity to Mexican maquiladoras and U.S.-Mexico supply chains.

Policy also plays a pivotal role in the ranking. Texas’s lack of a personal state income tax helps keep overall labor and living costs lower, which strengthens its appeal for employers looking to attract and retain talent.

For businesses, while a franchise tax does apply above certain revenue thresholds, Texas’s overall tax burden remains one of the most competitive in the country. Taken together, these factors make Texas a consistently attractive state for manufacturers planning both immediate launches and long-term growth strategies.

Top Cities in Texas by National Rank

Ohio: A Rising Hub for Manufacturing Start-ups

Columbus lands in third place with a Manufacturing Readiness Score of 75.9, driven by affordable rents ($10 per sq. ft) and a skilled workforce. Wages are higher than in Atlanta ($26.56/hr vs $23.97/hr), but the city benefits from major investments in advanced manufacturing, supported by government investment.

Recent developments, like Anduril Industries’ $1 billion hyperscale facility, showcase Ohio’s ability to attract cutting-edge manufacturing, while its geographical proximity to Canadian markets offers opportunities for trade and partnerships. This positions Columbus as a leading destination for startups in process manufacturing ERP and advanced automation.

North Carolina: The Southeast’s Emerging Manufacturing Hub

Charlotte (#4, 75.0) and Raleigh (#5, 74.2) make North Carolina the only state besides Texas with multiple cities in the top five.

Both cities combine affordable energy costs (6.71 cents/kWh) with relatively competitive wages ($23.31/hr), creating a strong environment for cost-conscious startups.

Charlotte’s strength lies in advanced manufacturing, financial services-linked industries, and a strong logistics network, while Raleigh benefits from its position at the heart of the Research Triangle, where universities and R&D institutions are driving innovation. This comes as pharmaceutical corporation Johnson and Johnson recently announced an investment of more than $2 billion to build a state-of-the-art biologics manufacturing facility in the North Carolina area.

Together, these cities represent a growing southeastern alternative to traditional hubs, offering cost competitiveness without sacrificing access to skilled labor. Favorable tax rates (2.25%) and state-level incentives reinforce North Carolina’s appeal as a manufacturing hub.

Michigan: A Traditional Industrial Hub Reinventing Itself

Detroit ranks sixth overall with a score of 71.2. Once synonymous with automotive decline, the city has reinvented itself by leveraging its industrial legacy, skilled workforce density, and affordable industrial rents (9$ sq. ft.) to attract new waves of manufacturers.

While average wages are higher than in southern states ($27.92 an hour), Detroit’s deep expertise in metal fabrication, automotive technology, and heavy industry makes it a prime location for specialized and capital-intensive manufacturing operations. Its position in the Midwest also ensures access to strong regional supply chains and transport corridors.

Nevada: The West’s Cost-Competitive Contender

Las Vegas in Nevada lands in eighth place with a score of 69.2, highlighting Nevada’s growing role as a manufacturing hub. Known primarily for hospitality, Las Vegas’ mix of low property costs and favorable tax environment are major attractions, particularly for manufacturers expanding westward.

The city is an increasingly compelling alternative to California and Arizona, where higher property and energy costs create barriers to entry. Competitive energy rates (6.71 cents/kWh) also put Nevada in league with southern states, reducing fixed overheads for manufacturers.

For manufacturers considering a cost-competitive gateway to the western US and Pacific markets, Las Vegas is a strategic contender, and Nevada also offers manufacturers relative insulation from severe weather compared with some more traditional hotspots, strengthening the appeal for risk-averse investors.

Hidden Headwinds for US Manufacturers

Manufacturers choosing a US base in 2025 face more than just straightforward rent, wage, and energy calculations. Beneath the headline figures are some hidden costs that can undermine competitiveness if overlooked.

Climate Resilience

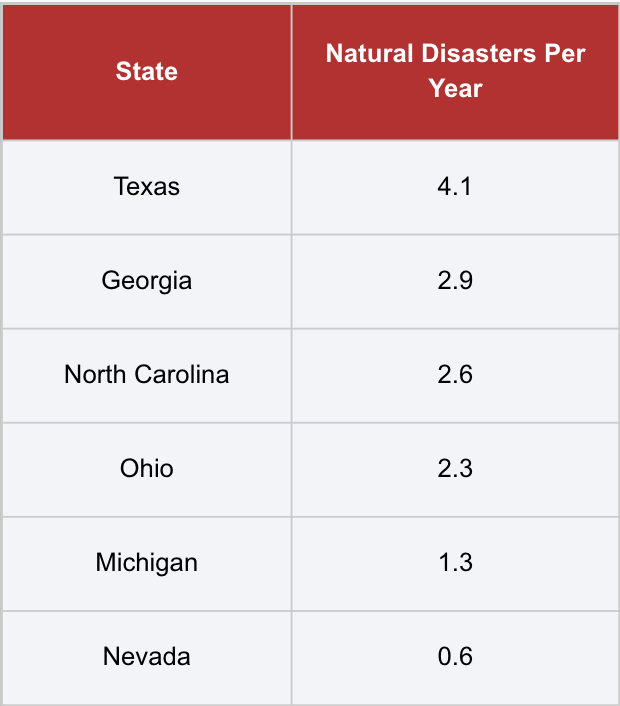

While costs and workforce remain important, climate resilience is also quietly shaping location strategy. Locations prone to hurricanes, floods, or wildfires face higher insurance and continuity costs, and have added risks of downtime and supply chain disruption.

Factoring in natural disaster risk highlights another layer of complexity, and where cost efficiency may draw companies southward, climate resilience increasingly favors the Midwest and West, making risk management a decisive part of site selection.

Average Annual Rate of Natural Disasters by Top States Analyzed (1980–2025)

Energy Volatility and Machinery Costs

Wholesale power prices across the US rose by more than 12% this summer compared to last year, driven by higher natural gas costs and inconsistent renewable generation, and the rapid power demand from AI data centers.

For manufacturers, this volatility creates cascading risks, ranging from higher operating costs, sudden transportation delays, and raw material shortages when suppliers also face surging utility bills. For manufacturers with lean margins, energy unpredictability is one of the hardest hidden costs to forecast.

At the same time, the cost of industrial machinery, from heavy equipment to precision tools, has been climbing steadily for a decade. According to Federal Reserve data, machinery prices have increased by 85% since 1994, with only a brief dip during the Great Recession.

The post-pandemic years have seen some of the sharpest spikes on record, including a 13.6% jump in 2022 and nearly 10% in 2023, as supply chain disruptions, steel shortages, and inflation drove equipment costs higher.

For manufacturers, these twin pressures can leave startups and scaling firms particularly exposed, as higher upfront investment in machinery and utilities can delay profitability or limit reinvestment in innovation.

US Machinery Price Index (2020-2024)

Tariffs and Trade Barriers: A Growing Blocker to Entry

Ongoing tariff battles are also hitting machinery, fabricated metals, and advanced electronics especially hard. The 10% universal tariff implemented in April 2025, combined with reciprocal tariffs that increased the effective US tariff rate by 15.8%, has fundamentally disrupted manufacturing planning cycles.

The impact of this has seen manufacturers report orders “utterly stopped sales globally and domestically” in some sectors, while also facing cost increases of 2-4.5%, making it difficult to forecast revenues or commit to investments.

Beyond immediate financial costs, tariff volatility combined with traditional business risks makes financial planning nearly impossible, forcing companies to build higher cost buffers into their operations while further challenging the US’s manufacturing competitiveness.

Practical Steps for U.S. Manufacturers

Strategic Takeaways for Leadership

While cost competitiveness is critical and forms the basis of much of this report, manufacturers should weigh other long-term factors:

- Location strategy must be multi-dimensional

Cost analysis alone isn’t enough. Factor in talent accessibility, climate resilience, and supply chain stability when evaluating sites. - Ecosystem support

Proximity to suppliers and logistics hubs can strengthen resilience and accelerate scaling. For businesses that import into and export out of the US, being closer to national borders, ports, or airports can be a major advantage. - Workforce sustainability

A cheap labor market today isn’t enough. Regions with strong training pipelines and universities will better support future growth, especially when it comes to scaling a business and hiring decision makers into key management positions. - Regulatory environment

Compliance requirements and permitting timelines can affect startup speed and costs. Efficiency is key for a new business, and extra hurdles put in place by city or state can massively impact how successful a business will be long-term. - Digital readiness

With automation and AI integration surging for manufacturers, reliable broadband and IT infrastructure are essential for adopting manufacturing management software and Industry 4.0 technologies.

Dean Dunagan, Vice President of Sales for MIE Solutions commented:

“Our research shows that the best places to launch a manufacturing startup in 2025 are no longer just the traditional hubs of the past. Cities like Atlanta, Houston, and Columbus are leading because they balance affordable operating costs with access to skilled talent and strong infrastructure.

“But behind those headline costs, every manufacturer is being forced to rethink strategy. Tariffs are reshaping global supply chains, and with government policy pushing production back onto U.S. soil, the conversation is no longer about whether reshoring will happen, but how. When I speak with customers, it’s clear that they’re looking at technology and automation as critical levers to drive efficiency, absorb higher labor costs, and create space for the investment required by this shift in strategy.

“What’s clear is that location strategy now requires more than chasing low rent or tax breaks. Manufacturers need to weigh workforce availability, energy stability, and long-term resilience, but also embrace new tools and approaches to remain competitive in this new manufacturing landscape.”

Forward Planning with Automation and ERP

Digital transformation isn’t optional in 2025—it’s survival. Manufacturing management software and ERP systems like MIE Trak Pro can centralize operations, reduce administrative burdens, and provide the agility startups need to navigate and scale operations.

Automation also helps to offset rising labor costs while maintaining quality standards, making it possible for companies to integrate these technologies early and gain sustainable advantages over competitors still relying on manual processes.

Build Resilient Human-Centric Operations

Business operations also need to be designed to adapt, scale, and compete regardless of external pressures.

- Balance automation with human expertise

Automation reduces costs and improves consistency, but skilled workers drive innovation and problem-solving. The most resilient manufacturers use technology to augment human capabilities and drive efficiency and productivity. - Invest in workforce development

Training programs are cheaper than competing for scarce skilled workers in tight markets. Close the skills gap in advanced manufacturing roles by partnering with local technical colleges, offering apprenticeships, and creating clear career progression pathways in an era of digital transformation. - Broaden employee incentives

Explore employee share schemes or stock options to attract and retain talent and also balance initial wage costs. In a market where skilled workers command premium salaries, equity-based incentives and compensation can help startups compete with larger employers while aligning with long-term business success.

Jaime Portecerro, Independent Business Transformation Consultant, added:

“Today, the reality is that the greatest cost in modern US manufacturing isn’t simply materials, machinery, or even labor. It’s the lack of operational leadership capable of executing at scale. The US needs a clear, unified ‘moonshot’ goal for manufacturing to drive a real, concerted national effort.

“For decades, we offshored production and, with it, much of the talent and institutional knowledge required to manage integrated manufacturing end-to-end. Success now demands a dual approach: leveraging automation and AI to take over repetitive, transactional tasks, while upskilling human talent to focus on strategy, innovation, customer relationships, and value creation.

“Operational excellence means creating a framework where data quality is maintained and decisions are consistent. But at the heart of it is treating your workforce as true partners in growth by offering equity, investing in long-term development, and aligning every employee with the company’s mission.

“By integrating operations across the Americas, building resilient supply chains, and focusing human effort on high-value activities, US manufacturers can not only survive in rapidly changing market conditions, but reclaim global leadership in advanced manufacturing.”

Methodology

The Cost of Manufacturing Index is based on a weighted analysis of over 50 US cities. Metrics included:

- Average hourly wages ($) – to reflect labor affordability and skill demand

- Energy costs (cents/kWh) – to capture regional energy efficiency and volatility

- Commercial property rents ($/sq. ft/year) – as an indicator of operating costs

- Commercial property insurance premiums

- State-specific tax rates – to assess the wider business environment

- Skilled job vacancy pipelines (data from LinkedIn) – to evaluate workforce availability

Each factor was normalized to a 0–100 scale and weighted by its influence on manufacturing success. Scores were then combined to create a Manufacturing Readiness Score, enabling cities to be ranked according to overall competitiveness in 2025.